What Is Consolidated E-Way Bill And How To Generate It?

E-way bill is mandatory now. For goods above Rs. 50,000 as mandated by the government in terms of Section 68 of GST Act, mentioned a circular released by Central Board of Indirect Taxes and Customs (CBIC). E-way bill can be generated from E-way Bill portal by the registered persons or transporters who cause movement of goods of consignment as told by CBIC.

What is a consolidated E-way bill?

It is a document containing the multiple E-way bills for multiple consignments being carried in one conveyance. That is, the transporter, carrying the multiple consignments of various consignors and consignees in one vehicle is required to carry one consolidated E-way bill instead of carrying multiple E-way bills for those consignments.

If you are a transporter/supplier who wants to move multiple consignments of goods in a single vehicle, you can click on the Consolidated E-way bill feature available on E-way bill portal.

However, before using this feature you need to login on the E-way bill portal and generate individual E-way bills.

Certain Prerequisites

- Registration on the E-way Bill Portal.

- You should have the Invoice/ Bill/ Challan related to the consignment of goods.

- Transporter ID or the Vehicle number (for transport by road).

- Transporter ID, Transporter document number, and date on the document (for transport by rail, air, or ship).

- Apart from those, the taxpayer must have all the individual E-way bill numbers of the consignments, to be transported in one conveyance.

Steps to Generate Consolidated E-way Bill

- Make sure you have generated individual E-way bills.

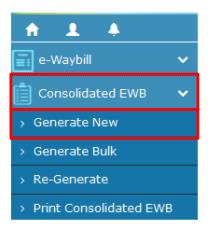

- Select ‘Generate New’ tab under the ‘Consolidated EWB’ option.

Image Source: (E-way Bill Portal)

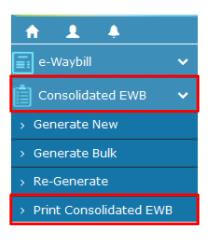

Image Source: (E-way Bill Portal)

- The following details are required to be entered in this step:

- Select ‘Mode’ of transport- Rail/Road/Air/Ship.

- Select ‘From State’ from the drop down.

- In the ‘Vehicle Starts From, field enter the location from where the goods are being

- Enter ‘Vehicle No.’

- Add the EWB no. and submit the details

- On Submission, a screen appears where E-way Bill in form EWB-02 with a unique 12 digit number is generated.

- Print this using ‘Print Consolidated EWB’ tab.

Image Source: (E-way Bill Portal)

Image Source: (E-way Bill Portal)

- Carry this document for transporting goods in the selected mode of transportation and the selected conveyance.

How does Bulk E-way bill generation works?

Big business houses and logistic operators have tons of consignments to deliver in a single day all across the country. They seek a simple smart time saving mechanism to generate E-way bills in a bulk quantity with a single file upload.

Certain prerequisites

- Registration on the E-way bill portal.

- You should have the invoice/challan related to the consignment of the goods.

- Transporter Id and the vehicle number (for road transport).

- Transporter Id, Transporter document number, and date on the document (for transport by rail, air or ship).

- If you are generating consolidated E-way bills then you must possess all the individual E-way bill numbers of the consignments.

Online method of E-way bill generation (Direct JSON Method)

- In this Bulk E-way bill generation method, the request for E-way bill is is accepted in the JSON format.

- Download the JSON template.

- Ensure that the codes entered in the JSON match with the parameters as specified in the code list.

- JSON file with multiple requests are allowed. However the E-way Bill System manual instructs to keep this number around 2000 requests to avoid uploading challenges.

Offline method of E-way bill generation

This method can be used by two different categories of taxpayers. Firstly, those taxpayers who have automated their supplies but are somehow unable to use the API interface. Secondly, the transporters/taxpayers who want to generate the E-way bills in one go by entering the bill details in a single excel file. On the taxpayers demand a separate tool has been made available on the E-way Bill portal for carrying out these actions.

Steps to use the offline method

- Download the excel template “ E-way bill JSON format. Or Consolidated Eway Bill JSON Format.xlsx

- Download the converter tool to convert multiple E-way bills/consolidated E-way bill excel file into a single JSON file.

- Update the excel template with required details.

- Use the .xlsm converter to convert all excel files to single JSON file.

The second method gives one important advantage over the online ‘updating JSON directly method.’ When you convert the excel templates into JSON format if errors are detected you can rectify them before uploading.

If you find the above process gruesome, save your time and energy by choosing the quick and easy GreenGST E-way Bill Solution.

3 thoughts on “What Is Consolidated E-Way Bill And How To Generate It?”

Leave a Reply

You must be logged in to post a comment.

Thanks for the great guide

Thanks for sharing this information..Have shared this link with others keep posting such information..

Thanks for sharing this information..Have shared this link with others keep posting such information..