Artificial Intelligence

Artificial Intelligence

Moglix amongst Deloitte’s 2020 Technology Fast 50 India list for the 3rd time in a row

Moglix amongst Deloitte’s 2020 Technology Fast 50 India list for the 3rd time in a row

Moglix has again secured a spot in Deloitte’s 2020 Technology Fast 50 India list for the 3rd time in a row. Securing the 1st spot in 2018 with a winning growth rate of 11,836%, our growth record has remained unbeatable in the last 3 years.

Deloitte Technology Fast 50 India programme that started in 2005 has now become a pre-eminent event that recognises excellence in technology in India. The programme recognises, honours, and encourages businesses and entrepreneurs who have achieved remarkable revenue growth rates by harnessing technology, innovations, and skilled human resources.

Moglix is proud to share this achievement with fellow tech disruptors like Urban Company, Rupeek, RateGain, DataBeat, Razorpay, Vedantu, and many others for being the fastest tech-enablers in the country.

How Technology is Accelerating Value Creation in the Manufacturing Sector

How Technology is Accelerating Value Creation in the Manufacturing Sector

Sandeep Goel, SVP- Technology shares his thoughts on how technology will pave the way for a futuristic manufacturing sector, at the Future Of Work Summit organized by YourStory.

He talks about the impact of COVID-19 and how it transformed the manufacturing sector in India. The pandemic accelerated the shift that Make in India has enabled in the sector, bringing about transformations, both physical and digital, boosting the self-reliance of India’s manufacturing sector.

Sandeep outlined key challenges that continue to persist in the sector, highlighting the need for streamlining order processing, and transaction data integration, and lack of intuitiveness when it comes to the application ecosystem.

He highlighted the role of technology in altering the future of manufacturing. How rapid advancements in digital technologies are revolutionizing business supply chains, and are poised to transform how the procurement function delivers value and enables swift decision-making in the ecosystem. He also talked about the need for constant connectivity as the norm, and how sensors are bringing devices and machines to life in the Internet of Things.

Read MoreMoglix Welcomes Neelam Dhawan as Board Advisor

Moglix Welcomes Neelam Dhawan as Board Advisor

Neelam Dhawan, tech pioneer, joins Moglix as board advisor. Neelam has previously worked at Hewlett Packard (HP) Enterprise and Microsoft, IBM and HCl, among other companies.

Currently, she is a supervisory board member at Royal Philips, Netherlands, and non-executive director at ICICI Bank India, Skylo Technologies, Capita PLC, and Yatra Online. Moglix said it plans to start a new phase of global expansion.

“I am excited about my new role as a board advisor at Moglix. Moglix is pioneering supply chain digital transformation in the country and overseas. I look forward to contributing to Moglix’s endeavors to grow and deliver impact globally at scale.”

Neelam has been instrumental in shaping the IT industry in India. Throughout her career, she has repeatedly demonstrated leadership, innovation, and fearlessness, values that we hold in high esteem at Moglix. The scale of operations and innovation that she has successfully implemented, and her vision resonate strongly with the mission of Moglix to reimagine B2B commerce and supply chain at scale globally. We are delighted to have her as the board advisor at Moglix.

Moglix CFO: The role of a CFO goes beyond finance when it comes to startups

Moglix CFO: The role of a CFO goes beyond finance when it comes to startups

Rahul Goel, Vice President- Finance, talks about the challenges and success factors of new-age CFOs. Having worked with both startups and MNC’s, Rahul believes that the role of a CFO goes beyond finance when it comes to startups. He dissects various challenges that CFOs face in the startup world especially in the tech space, followed by the successes that lead around for CFOs.

A finance professional for over two decades, the Moglix CFO believes that two major factors that are often ignored by most financial heads at companies are growth and governance which play an important role in the journey. He stated that Indian companies have yet to understand the business model and efficiency of tech startups so that they can be evaluated correctly.

Given that tech startups ought to have cross-functional leaders, the biggest challenge for a CFO is balancing the speed and agility of the finance operations with the other parts of the business from product to marketing. “In the early stage of that product, the resources might be limited but the speed at which the company wants to run might be very fast,” Rahul added, highlighting the need for CFOs to learn about other domains to react in a quick manner.

One of the most crucial tasks for a CFO is fundraising. A new-age CFO needs to assume responsibility for the complete fundraising cycle — from the timing of the fundraise to creating a healthy financial picture to meeting with advisors to identifying the right strategic partners and attracting the right set of investors.

Rahul states that it is crucial for any company to hire a CFO from the start itself in order to be successful. One needs to be more agile, fast, and innovative in order to reach the business requirements and when it comes to tech startups, CFOs need to be dynamic. He explains how important it is in a tech startup, such as Moglix, to focus on key performance indicators.

Read MoreMoglix launches digital supply chain financing platform Credlix

Moglix launches digital supply chain financing platform Credlix

Moglix launches digital supply chain financing platform Credlix with the aim to provide quick collateral-free working capital solutions for its 15000+ suppliers and make the supply chain ecosystem future-proof from disruptions.

Credlix aims to make it easier for the suppliers to get just-in-time payments through its technology-driven supply chain financing system. Suppliers will be able to request early payments from enterprise buyers at affordable discount rates to keep their supply chain up and running even during times of disruption.

Rahul Garg, Founder & CEO, Moglix said in a statement,

MSMEs in India account for 11 crore jobs and 29% of the country’s GDP. Unclogging the cash flow through the supply chain will be integral to fostering winning partnerships between MSME suppliers and large enterprise buyers and realizing the Government of India’s vision for Aatmanirbhar Bharat.

Credlix is on track to provide invoice discounting of Rs 1000 crore over the next 12 months and is aiming to touch Rs 10,000 crore discounting value over the next three years by scaling up to include more banks, suppliers, and geographies.

Read MoreIndia`s Covid Vaccination Drive: A Road To Self-Reliance

India`s Covid Vaccination Drive: A Road To Self-Reliance

Rahul Garg, CEO & Founder, discusses how India’s covid vaccination drive will lead its journey to self-reliance. As the vaccine rollout in India has crossed one million doses within a week of inception. India accounts for 60% of the world’s manufactured vaccine output and our global partners are looking up to us to help them out of the crisis.

Naturally, this has become a crucial moment for India, as our capability to drive the vaccination manufacturing and supplies for our global partners will determine our focus and determination towards becoming self-reliant.

India’s COVID19 vaccine supply chain design has to be based on optimizing multiple objectives of cost, quality, and delivery. Collaboration among the stakeholders namely pharmaceuticals companies, logistics services providers, warehousing companies, and government agencies is the key to achieving this.

Rahul also says that this mission is guaranteed to be a success with all the stakeholders enrolled in a compact and connected supply chain platform to bring visibility to the order to delivery processes and track each stage of the supply chain journey.

Read MoreThe solution is to integrate the individual supply chain functions of every stakeholder into a gross objective function of ensuring COVID19 vaccine for a maximum number of people at minimum costs.

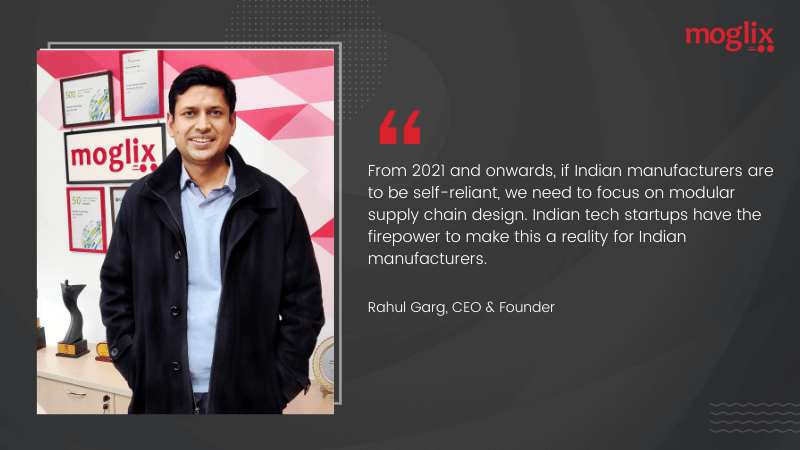

Tech Startups Innovations Will Enable Growth For Manufacturers In 2021

Tech Startups Innovations Will Enable Growth For Manufacturers In 2021

Rahul Garg, CEO & Founder, elaborates how innovations by tech startups will enable growth for manufacturers in 2021. He takes a walk down last year’s memory lane, connecting it to our action-plan for 2021 and beyond. From accepting the need

Tech startups will have opportunities to add value to creating a National Supply Chain Network that will bring all stakeholders on the same platform through digital connectivity. Digital connectivity will be critical to building agility, speed, and scale capabilities as Indian manufacturing enterprises look to get a more significant share of the global value chain in manufacturing.

Rahul also says that we need to segregate the supply chain ecosystem into a sum of parts that can be stitched together on-demand through combinatorial innovation to pivot with agility towards goods essential to creating jobs and protecting livelihoods. Solutions driven by scalable technologies like cloud computing, artificial intelligence, and machine learning can make this happen.

The aim is to have a vision today of becoming self-reliant and then to live this vision tomorrow. The key lies with Indian tech startups, they need to reverse the direction of innovation; focus on providing solutions to our local challenges first and then scaling up successful products across markets in the rest of the world.

Read MoreTech Startups Enabling the New Normal will Experience Viable Growth

Tech Startups Enabling the New Normal will Experience Viable Growth

Rahul Garg, CEO & Founder talks about how tech startups enabling the new normal will experience sustainable growth. Tech-integrated supply chains are on the rise more than ever due to the major set-back in 2020. T

Tech startups that have lived up to the promise of ensuring business continuity, workforce collaboration, and effective remote working for their enterprise customers have thrived.

He throws light on the growth that these startups have achieved supernormal growth during the pandemic. He also talks about how the pandemic has seen a surge in demand for technology-enabled solutions that allow enterprises to reduce their exposure to financial and health risks.

During the pandemic, enterprises have pivoted towards outcome-based digital transformation initiatives and have put outlay-based projects on the backburner.

Technologies that have experienced a dip in demand are data center systems, enterprise software, devices, ITeS, and communication services.

Tech startups offering business transformation solutions, business process re-engineering, and modernization of legacy applications and systems have been at the receiving end of reduced expenditure by enterprise customers.

Read MoreMoglix Listed as One of the Top 10 Indian Startups of 2020

Moglix Listed as One of the Top 10 Indian Startups of 2020

Moglix has been listed as one of the top 10 Indian Startups of 2020. As the year gave a hit to many startups, a few used this opportunity to create new possibilities.

The Ratan Tata-backed e-commerce B2B platform Moglix is also claimed as one of India’s next unicorns.

Moglix specializes in the procurement and supply chain across industries, such as Automotive, FMCG, Pharmaceuticals, Cement, and more. Moglix is backed by IFC, Accel Partners, Jungle Ventures, Venture Highway, SeedPlus, and Rocketship. It has been recognized for innovations by CIPS Asia Awards, Samurai Awards, Globee Awards, among others.

Read More

My vision for Moglix is to change the face of industrial commerce: Rahul Garg

My vision for Moglix is to change the face of industrial commerce: Rahul Garg Now and Next in the Infrastructure Sector

Now and Next in the Infrastructure Sector Moglix enabled Agile MRO Procurement at Scale through Workflow Digitization of large EPC company

Moglix enabled Agile MRO Procurement at Scale through Workflow Digitization of large EPC company