What Does the Road Development Boom Mean for EPC Companies

What Does the Road Development Boom Mean for EPC Companies

“My target is to achieve 100 km per day of highway construction,” said Nitin Gadkari, Union Minister for Road, Transport & Highways, addressing a virtual event organized by industry body CII in August of 2021.

This was the road development goal he set for the various EPC companies in India and the different governing agencies to pull up their socks and build using sustainable material, but to also build faster!

The emergence of the National Infrastructure Pipeline is suggestive of what to expect from India’s government going forward.

The National Infrastructure Pipeline (NIP) is a five-year package of social and economic infrastructure projects in India with a total sanctioned budget of 102 lakh crore (US$1.4 trillion). The pipeline was initially announced by India’s Prime Minister Narendra Modi during his Independence Day speech in 2019.

As part of the NIP, roadways, expressways, highways, road construction projects in India, railways and power sector assets will encompass over 66% of the total estimated value of the assets to be monetised. The remaining upcoming sectors include telecom, mining, aviation, ports, natural gas, and petroleum product pipelines, warehouses, and stadiums.

For EPC companies in India, this boom in road development projects means they are now in a position to build back better. However, procurement of construction materials will be critical for them to complete these infrastructure development projects within budgeted time, cost and quality.

Timeliness: EPC companies in India will require an agile supply chain for on-time procurement of construction materials. With a digital procurement solution, they can now streamline their sourcing, logistics, and even payments.

It results in the faster delivery of turnkey projects than a traditional model of offline procurement. Simple aspects like being able to digital monitor the various stages of the logistics journey lead to better visibility into the time to sustain in case of a disruption.

Cost: EPC companies need to ensure they are in the best position to negotiate the best cost. A diverse and inclusive supplier base is the key to getting the most competitive cost quotations on construction materials.

A diverse supplier base managed through a single point of contact enables raw material suppliers to be competitive. EPC companies can get the best product at the lowest price point, without skimping on delivery, quantity, or quality.

Quality: Meeting the custom quality specifications for materials like TMT bars, cement, plates, steel, and ready-mix concrete is critical for EPC companies to build high quality roadways, expressways, highways, and bridges. With clean procurement data, EPC companies can reduce the risks of order-supply mismatches.

EPC companies in India will be the change-makers, enabling transformation and fueling the growth of infrastructure development projects in India.

Being in the unique position to enable the procurement of construction materials such as TMT bars, cement, plates, and ready mix concrete, gives EPC companies an edge to deliver the value that the National Infrastructure Pipeline seeks to create.

If you are in the business of infrastructure, construction, or development, then chances are you will benefit from Moglix procurement solutions for infrastructure development projects. To know more visit https://business.moglix.com/our-solutions/infrastructure

Tesla’s Record Results Despite Supply Chain Disruption

Tesla’s Record Results Despite Supply Chain Disruption

Tesla has weathered its share of supply chain disruptions in a manner “unrivaled in the auto industry”. While other automobile manufacturers have reported a decrease in sales, Tesla has bettered it’s net earnings.

It had posted USD 1.14 billion in the second quarter of 2021. In the third quarter, Tesla posted a record quarterly net earnings of USD 1.62 billion and sales of 240,000 vehicles.

What Tesla Got Right But Others Did Not? Managing Multiple Supply Chain Disruptions

All automobile manufacturers were affected by global semiconductors shortages, which left procurement professionals in the automobile industry short on accessible stock and consumers with fewer options.

Many issues, including semiconductor shortages, port congestion, and rolling blackouts, have hampered automobile manufacturers’ ability to maintain plants functioning at full capacity. Even Tesla has conceded that global supply chain disruptions had made the achievement a little challenging.

However, Tesla got three things right that allowed it to navigate across troubled waters. These are supplier base management, collaboration with suppliers, and better forecasting and planning.

Supplier Base Management and Chip Substitution: Agility at Play

Elon Musk, CEO of Tesla, revealed that the company handled the worldwide chip shortage by upgrading its car software to handle alternate processors.

Due to a growing demand for new automobiles, the gap in supply upended the auto industry. It resulted in factory shutdowns, longer wait times, and higher pricing.

However, Tesla has over the years invested in its supplier base management program. It has built a diverse and inclusive supplier base enabling it to switch to different chips and develop the software in a few weeks.

Working with Vendors to Co-Create a Custom Product: Collaboration in Focus

Tesla was able to quickly put together a custom product. Tesla’s ability to identify the right supplier through a pre-defined approval system enabled it to co-create the customized product in a very short period of time.

It enabled the production, engineering, and supply chain teams to quickly move forward and build the product according to specifications that were pre-set. Tesla’s collaboration with suppliers enabled it to demonstrate agility at scale for its indirect procurement.

Early Visibility for Better Forecasting and Planning: Digital Supply Chain Transformation

Tesla was able to identify the challenges quite early on. Its digitally integrated supply chain with multiple suppliers, logistics services partners, and warehouses onboard worked as an early warning and control system.

Early visibility into the divergence of its supply chain KPIs from expected values allowed it to pierce the mist on the screen. It enabled the automobile manufacturer to forecast and plan better.

To know more about how an indirect procurement solution can work for automobile manufacturers, reach out to Moglix. Explore the best indirect procurement solutions for automobile companies. Click here to know more: https://blog.business.moglix.com/optimize-mro-procurement

This Sea Link Bridge is Rewriting Procurement for Infra Projects in India

This Sea Link Bridge is Rewriting Procurement for Infra Projects in India

The Mumbai Trans Harbour Link (MTHL) is also known as the Sewri Nhava Sheva Trans Harbour Link. It is an under-construction 21.8 kilometres , freeway grade road bridge connecting the Indian city of Mumbai with Navi Mumbai, its satellite city.

Mumbai Trans Harbor Link: The Longest Sea Link Bridge in India

When completed, it would be the longest sea bridge in India. The bridge will begin in Sewri, South Mumbai, cross Thane Creek north of Elephanta Island, and terminate at Chirle village, near Nhava Sheva. The road will link to the Mumbai Pune Expressway in the east and to the proposed Western Freeway in the west. The sea link will contain a 6 lane highway, which will be 27 meters in width, in addition to two emergency exit lanes, edge strip and crash barrier.

A Turning Point for Infrastructure Development in India

The project is estimated to cost ₹14,262 crores (US$2.0 billion). The MMRDA awarded contracts for the project in November 2017; construction began in April 2018 and is scheduled to complete within four-and-a-half years. The MMRDA estimates that 70,000 vehicles will use the bridge daily after it opens.

Agility At Scale for Infrastructure Development in India

Infrastructure development in India has only ever been conducted on a PPP basis. The MTHL is one of the largest projects in India to be delivered using an EPC-Design-Build program. This project is also one that is being built in three phases or three packages as they are known – all of which follow the same design guidelines provided by the MMRDA and all other authorities involved.

The MTHL is being labelled as one of the most significant EPC projects in India. This means the sheer number of consultants, contractors, and companies involved in this project are already higher than ever before.

In addition to this, raw material procurement solutions for infrastructure companies will play a big role. EPC Companies, as well as all the materials used, need to go through rigorous approvals and inspections before being deployed on a project of this magnitude.

Raw Material Procurement Solutions for Infrastructure Companies: The Secret Sauce

This project represents just one thing. It is one massive infrastructure project with a lot of moving parts. The scale of raw material procurement is unprecedented. It is a single digital procurement ecosystem that allows granular control and visibility on the end to end supply chain.

It is also one of the first infrastructure development projects to rely on a fully digitally integrated procurement solution. The project is reimagining procurement for infrastructure development projects in India.

The Takeaway for Infra Procurement Organizations From the Project

The right procurement solutions for infrastructure companies can reduce the PR to PO cycle time in procurement by up to 80%. The agile PR to PO cycle time can result in 20% cost savings due to integrated supply chain, and even a 30% rise in operational efficiency.

All of these are a result of digital procurement maturity to track the end to end supply chain journey of raw materials. Any way you look at it, though, this project is rewriting procurement, as processes need to be quick, reliable, consistent, and efficient.

To know more about how an EPC solution can work for your construction or infrastructure project, reach out to Moglix. Explore the best raw material procurement solutions for infrastructure companies. Click here to know more: https://business.moglix.com/our-solutions/infrastructure

Moglix is set to transform the Packaging Industry in India

Moglix is set to transform the Packaging Industry in India

Rahul Garg, CEO & Founder, Moglix says ‘We are set to transform packaging industry in India’ and talks about how Moglix has become India’s largest cost-effective packaging solutions provider. Moglix is enabling brands to adopt end-to-end sustainable packaging solutions. We are partnering with brands to help them identify and transition so they can achieve packaging sustainability compliance ahead of the phased SUP ban to be effective from 2022.

Our packaging vertical is meeting the packaging needs for more than 70% of e-commerce orders in the country. We are giving source-to-site packaging supply chain solutions to large manufacturers across industries to resolve their challenges of limited shelf life of perishables, pilferage, spoilage, and wear and tear during transit journeys for domestic and global trade. Moglix is also focusing on Food & Beverages, Textiles, Cosmetics and Personal Care, Pharmaceuticals and Healthcare, Automotive Packaging solutions.

As a brand, the packaging for your product is a manifestation of all the effort gone into your product. As a user, the moment you see the packaging, you are assured of the safety and quality of the product. That is why packaging holds a special place for businesses.

Rahul, says

Moglix is a one-stop solutions provider for packaging needs. Our products go through 3 levels of quality check and comply with government regulations. We are reducing the costs of compliance with the amendments to the Plastic Waste Management Rules, 2021 that will come into effect from July 01, 2022, and enabling large enterprises to hit the ground running with agility. Through our supplier capability mapping process, we are continuously expanding our pan-India packaging supplier base, thereby reducing the costs of supplier search and product development for sustainable packaging solutions.

The ET Cutting Chai Stories in conversation with Sandeep Goel

The ET Cutting Chai Stories in conversation with Sandeep Goel

Catch Sandeep Goel, Senior Vice President, Strategy & Operations, Moglix in the recent episode of ET Cutting Chai Stories with Ashwani Mishra, Consulting Technology Editor.

In this interesting conversation, Sandeep very humbly talks about his childhood experiences, learnings and defining moments of his career that shaped him into the optimistic leader that he is today, “looking at the glass half-full glass and not the empty part”.

Connectivity, Convenience, and Analytics: Digital Supply Chain Transformation in Action

Connectivity, Convenience, and Analytics: Digital Supply Chain Transformation in Action

Prior to the COVID19 pandemic, manufacturing enterprises in India often relied on a highly fragmented supplier base. With few exceptions, replacing hundreds of vendors with a few strategic ones was not common. Procurement teams often made multiple small value purchases. Often, and perhaps by design each supplier got a small piece of the procurement pie, depriving them of opportunities to scale up. No supplier had the incentive to think beyond the purchase order at hand and invest in best practices, process improvements, systems and customer-dedicated investments.

Communication with suppliers was done largely through paper records, emails, and spreadsheets. While many firms used ERP systems, few suppliers were integrated seamlessly with those ERPs.

The pandemic severely tested this inefficient system. Overnight, suppliers were shut either due to regulation or due to shortage of manpower. Communication channels broke down. Working capital was a challenge. Order tracking and visibility was non-existent. Finding alternate suppliers was a slow and arduous process. In short, the supposedly solid supplier ecosystem, wasn’t quite what it was made out to be.

Read MoreEncouraging women’s role among MSMEs can lead to sustainable growth

Encouraging women’s role among MSMEs can lead to sustainable growth

Building back better for women means challenging the status quo of women’s participation in the economy. Women constitute 48% of the population but form only 21% of the workforce. For the MSME sector, it means raising the bar above its current contribution of 30% of the GDP.

Impact of the Pandemic on the MSME Sector and Women

Last year at the height of the first wave 43% of the MSME sector, that is 75 Million MSMEs were faced with the risk of closure. The threat to the MSME sector implied that 33% of India’s manufactured output and the job opportunities for a substantial proportion of 120 million people were at risk.

Women’s participation in the economy is one of the quickest ways of empowerment and sustainable growth. The pandemic has negatively impacted 73% of women entrepreneurs, and 20% had their revenue nearly wiped out. Another 35% of the women entrepreneurs experienced a decline of 25%–75% in revenue.

Women Can Turn Around the fortunes of the MSME Sector

● Connect Womens’ Entrepreneurial Spirit to Market Access

● Enable Digital Empowerment of Women

● Connect Women Entrepreneurs to Digital Credit Platforms

If 50% of women join India’s workforce, the Indian economy can add up to 9 percentage points to the real GDP growth rate.

Moglix is on its way to build smarter and faster procurement and logistics solutions

Moglix is on its way to build smarter and faster procurement and logistics solutions

Moglix is a digital solutions enterprise with an obsession for customer service. The excellence of our supply chain operations defines who we are and what we do to meet our customers’ requirements. Furthermore, I believe that leadership wins through superior logistics. Our success in the B2B commerce space is rooted in our ability to leverage technology to bring greater visibility and predictability to the supply chain journey for our customers.

We have always believed that the whole is greater than the sum of its parts. This is reflected in our endeavor to roll out a full-stack integrated operating system for procurement and supply chain.

Be it our Moglix Supplier Central application for procurement and supplier relationship management, our Moglix catalog for indirect procurement, the Moglix Buyer’s app for order management and real-time order tracking, or the warehouse and field management system for efficient logistics operations, users from our customer enterprises get to access all these modules or customized bundles from a single operating system.

Moglix’s technology has always been about unlocking new avenues of efficiency through the integration of suppliers, customers, and logistics. At Moglix, we are using technology to build smarter and faster procurement and logistics solutions for creating a great customer experience.

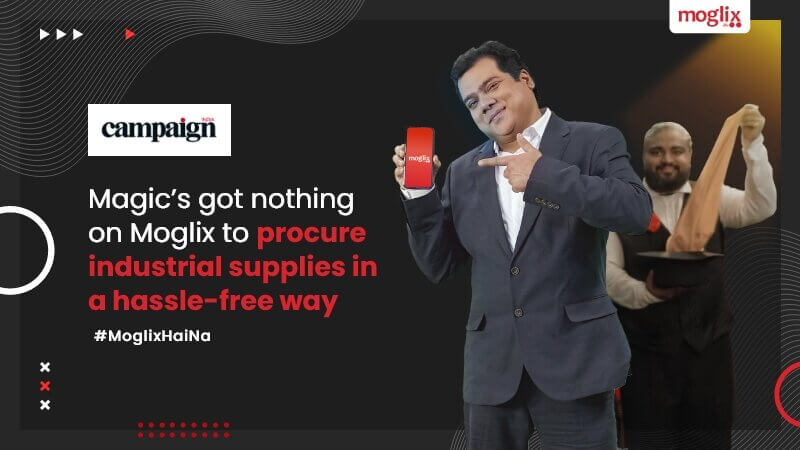

Magic’s got nothing on Moglix to procure industrial supplies in a hassle-free way

Magic’s got nothing on Moglix to procure industrial supplies in a hassle-free way

Moglix has launched an ad film as part of its ongoing #MoglixHaiNa (there is Moglix) campaign. The campaign is aimed at showcasing the burden faced by procurement managers in sourcing daily responsibilities.

Conceptualized by Bedlam Studios, the film looks to educate customers about the ease and convenience offered by Moglix through its e-commerce platform. The film is staged against the backdrop of a procurement talent hunt. The procurement manager Mishraji attends the hunt organized by his team and is introduced to a magician, who his team claims can procure any material through magic. In the middle of the act, the magician forgets the magic spell and still denies defeat. Meanwhile, Mishraji showcases the ease of buying on the Moglix app to get timely delivery and assured quality of the items required.

“We wanted to showcase the lives of procurement managers in a fun way, to bring the spotlight on procurement teams who are the backbone of the organization but not recognized or celebrated. The films try to bring to life the quirks of daily work life in a procurement department, a segment that has never before been addressed before.”

says Pallavi Chelluri, Director, Moglix

“India operated pretty much without catalogues pre-Moglix. We are ecstatic with the launch of the ‘Moglix Hai Na’ digital campaign which catapults Moglix as a brand that is building the catalogue for India. We are confident that this campaign will resonate with our brand’s philosophy and further strengthen our position as India ka catalog across India.”

says Jigyasa Kishore, Senior Director, Moglix.

The campaign is rolled out on digital and OTT platforms.

Enabling low-cost innovation and value creation in procurement

Enabling low-cost innovation and value creation in procurement

Procurement organisations in India will have to assume a much bigger role in value engineering in a post-pandemic world. Any consignment remains stationary for 80 percent of the time in the supply chain journey.

When a consignment remains motionless, it appears not in the market where the end customer is waiting to access it, but in different warehouses and data management systems. This is the biggest supply chain paradox. This is the Keynesian “unintended accumulation of inventories” that has negative consequences on cash flow, cash conversion cycles, and inflation of warehousing real estate rentals and logistics. It also results in wastage of utility and lost sales opportunities.

Ease of doing business through the lens of procurement agility in the supply chain

One of the chief reasons behind this inertia is to be found in the digital divide facing procurement. Typically procurement organisations that operate with offline processes take anywhere between two to three hours to complete a procurement transaction, whereas those that operate with digital procurement platforms take three to five minutes.

Coming out of the pandemic, procurement organisations in India will have to assume a much bigger role in value engineering than being caught up in routine tasks. These include collaboration across the end-to-end value chain; enabling low-cost innovation; and ensuring faster completion of industrial projects.

Enabling low-cost innovation by sourcing mission-critical components

Procurement organisations will have to leverage sourcing of components and sub-assemblies to make low-cost innovation a reality. The rollout of low-cost innovative goods has the potential to invite the interest of large OEMs to make in India for the rest of the world. A great example of such affordable innovation is the low-cost air ventilator recently developed by the IIT Kanpur consortium; a life-saving product for patients in the face of Covid-19.

The future of supply chain and procurement in India

Procurement systems create a favourable feedback loop that percolates to the downstream supply chain by enabling faster go-to-market. Ease of procurement will be integral to unlocking demand at all levels in the supply chain for enabling faster rebound of economic growth.